One of the most important aspects of successful trading is knowing that your trading method has an edge over the market. Theoretically speaking an edge is defined as a set of conditions which when present gives a higher probability of a trade working than not working. These conditions can be based on price, indicators, chart patterns, economic indicators or any other factor one uses for making a trading decision.

For me it is a little more than that. It is all the above plus how you execute your strategy – an important element which if ignored can result in suboptimal performance from an otherwise good strategy. Trading edge is as much a function of your implementation and trade management as of the entry and exit criteria.

So how do you know whether your trading method i.e. combination of your trading strategy and implementation gives you an edge over the market?

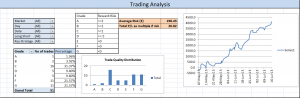

The truth is in the numbers. If your equity graph is on the upward trend over a series of trades and over a long period of time, you have an edge. There are two different schools of thoughts on whether you should trade real money before establishing if your trading method provides you with an edge or not. First, you back test and forward test the method on a demo account prior to risking hard earned Capital. The second, taking psychological aspects into account, you back test the method on demo account, and forward test with real money, for you can’t really test a method holistically unless you have also tested the ‘fear’ and ‘greed’ factors that come into play while executing.

My own preference is the latter, but with considerably reduced risk on froward test with real money. For automated strategies a purely demo account testing would be as good because automation takes away the psychological aspects. But when it comes to discretionary trading, I strongly recommend a round of testing with real money in play.

Coming back to the question of how you establish whether you have an edge. I wish I could say there is a magical secret to it however, what really provides the answer is hard work, discipline and perseverance.

The answer lies in journaling and analysing trades – easier said than done. Especially for new traders who are usually more focused on making money rather than fine-tuning their trading activity. One immediate advantage of journaling every trade is that it will stop you from taking poor quality or random trades. The quality of your journal and the analysis you are able to perform on it will ultimately give you an indication of what works for you, and what doesn’t. I recommend analysis to be performed on blocks of at least 50 trades or 50 days of trading activity, whichever happens later.

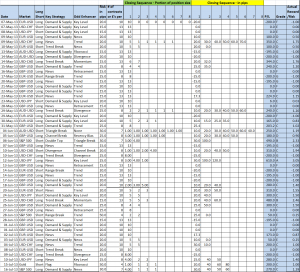

There is no standard approach to analysis. You will need to develop something aligned to your trading method, style and objectives. My suggestion is to be able to analyse the quality of trades (based on reward to risk ratio it produces) for a given market, key strategy, confluence factor, risk, day of week, time in the trade or a combination of such parameters. In addition, if you are looking at scaling up the risk, then you should also take into consideration the draw-downs (maximum dip from a peak to trough before recovery). You will be surprised at what you discover, and trust me it will help in your development as a trader. I present here a simple example of Trade Journal (data fictitious) and possible analysis one can perform on it:

Trading Journal

Hope this is useful for your trading. If you have any questions or would like to discuss this very important subject, please send me an email on contact details provided on the website. Happy trading!

Trading the financial markets (Stocks, Forex, Futures, Spreadbetting etc) has risks associated with it. Whilst it can be extremely rewarding, it can also result in losses, which if not managed properly can exceed your initial investments. Before embarking on trading, please ensure you understand the risks involved.