“Jane, an experienced trader, has had a few good months trading Forex. Her strategy is returning a pretty good profit. Her confidence is high. She thinks of making the good run count and starts playing with twice her normal position size. Unfortunately she has a string of losing trades and in a matter of days gives away two months’ worth of profits back to the markets. It not only dents her trading account but also confidence in her strategy; and creates whole lot of other psychological issues impacting her trading behaviour resulting in further losses!”

Does it sound familiar? I must admit it happened to me more than once in my early days of trading journey.

Ability to scale up is one of the big advantages of trading profession. Imagine a two, three, five or even tenfold increase in your earnings by doing the same amount of work? But if not handled properly it can result in a ‘one step forward and two back’ kind of story.

Why is scaling up so difficult then?

There are two main challenges you face when you scale up in trading. One, when you trade increased positioning size the amount of open profit or loss a trade shows up as the market moves is now bigger than you were used to before. Are you able to handle the fear and greed factors associated with the likelihood of an increased loss or profit? Are you still able to keep calm and execute your strategy methodically as you did before? If you can’t – STOP and revert to your previous successful position size.

The second challenge is how do you manage your trading if you run into a string of losses with the increased size? Should you revert back immediately after a loss or wait out a few losers? How many losses can you take? What if the string of losers continues longer than you anticipated? What if you reverted to previous smaller position size and the next trade turns out to be winner?

Over the years I have adopted a simple method that is working for me. It stops me from randomly changing the position size, guides me to scale up with confidence. And, in the event things don’t work out, it guides me to scale back before it is too late.

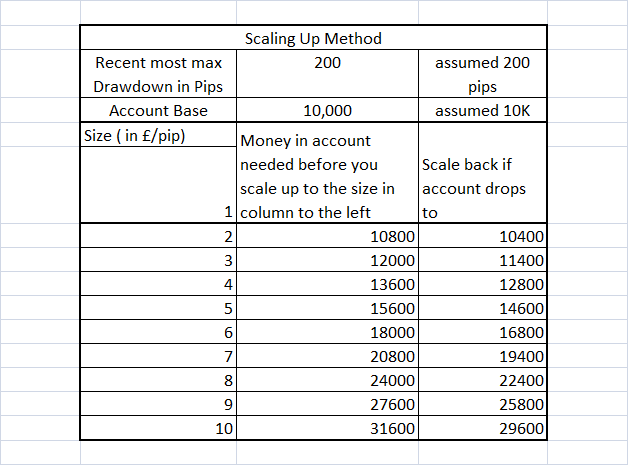

A key ingredient to my method is the size of recent most maximum drawdown measured in pips. This is the number of pips you lost from recent most high watermark on your account to the lowest point before returning back to breach that previous high watermark again. Lets us denote it by letter D. Let’s denote your current position size as P and the aspired new (scaled up position size) as NP.

Here is my method:

- Wait until you have accumulated 2xDxNP in profits with size P before you change your position size to NP.

- Keep trading with same confidence as before in the knowledge that you are using markets’ money for increased size (you did accumulate profits – didn’t you!)

- If a string of losses happen so that you have hit losses equal (in pips) to previous drawdown (1xD) – STOP and revert to position size P.

- If losses continue – it means you will need to revise D, (and probably scale back further or even review your trading strategy itself!)

- Go back to step 1

A simplified illustration is given below:

If your account operates in terms of number of contracts (instead if £/pip used in the illustration above), you will need to appropriately adjust the spreadsheet.

This is not a Holy Grail method and might not work for all. This is only an approach and you might want to tweak it to suit your own trading goals, risk appetite and personality.

Hope this is useful for your trading. If you have any questions or would like to discuss this or any other trading subject, please send me an email at: [email protected]

Happy trading!

One reply on “Scaling Up – Why is it so difficult?”

Hello Sir, My name is Danny. Pleasure to meet you!

I recently saw your videos on youtube (I founded them via John Lee) and they are very good and make perfect sense. I also checked your website and you have interesting articles. I am just sad that you stopped making videos.

I have a favor to ask you.

I am new in trading and do not have much experience with it. Few weeks ago I tried Binary Options and unfortunately lose all the money.

My goal in the future is make a lot of money and take care of my mum and brother. Create new educational content like you and pass it to other people and become famous youtuber.

Can you Please mentor me on Forex Trading, I would be very thankful. If I can help you somehow, please feel free to contact me. I would not mind to work for you for free at all. All I am asking is education.

I have experience with web designing and developing, facebook and instagram marketing.

I know that you stopped a long time ago and the chance you get notice my letter is small, Hope you will be able to see it

Thank you very much.

I will be waiting for your response.

Sincerly

Danny